5 Popular Tools for Financial Health Assessment for MSMEs

Periodic assessment of financial health is not a luxury—it’s a necessity for MSMEs navigating volatile markets, managing working capital, and seeking institutional funding. Whether it’s improving internal efficiency, preparing for scale, or ensuring compliance, data-driven financial diagnostics are now integral to strategic decision-making.

Why Periodic Financial Health Assessment is Crucial

For MSMEs operating on tight margins and often dependent on seasonal revenue flows, timely financial insights can be the difference between sustained growth and operational stagnation. Periodic financial health assessment helps:

- Identify cash flow bottlenecks

- Monitor debt-service capacity

- Improve creditworthiness

- Align operational expenditure with revenue cycles

- Strengthen preparedness for audits, funding, and government incentives

Moreover, with initiatives like the Udyam portal and formalisation drives, lenders and regulators increasingly expect transparent, up-to-date financial reporting.

How Financial Health Assessment is Conducted

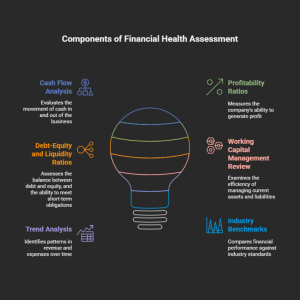

A comprehensive assessment typically includes:

- Cash Flow Analysis

- Profitability Ratios (e.g., Net Margin, ROCE)

- Debt-Equity and Liquidity Ratios

- Working Capital Management Review

- Trend Analysis for Revenue and Expense

- Comparison Against Industry Benchmarks

The analysis combines internal data (P&L, balance sheet, bank statements) with sector-specific indicators. While chartered accountants and financial consultants have traditionally done this manually, digital tools are streamlining the process significantly.

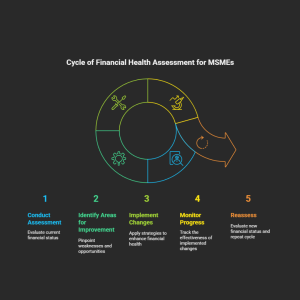

Cycle of Financial Health Management

Components of Financial Health Management

Why MSMEs Are Automating Financial Diagnostics

Manual tracking is error-prone, time-consuming, and unscalable. Automation addresses these pain points by:

- Reducing human error in calculations and reporting

- Improving decision-making through real-time dashboards

- Increasing financial discipline by making trends and anomalies visible

- Speeding up funding processes, as banks prefer digitally verifiable data

- Enhancing forecasting accuracy with AI-powered tools

Automation is not about replacing human expertise—it complements it by reducing friction and enabling faster response to red flags.

5 Popular Tools for Financial Health Assessment in India

- Clear (formerly ClearTax)

Offers integrated GST, income tax, and financial reporting tools. The business dashboard provides a quick view of cash flows, dues, and profitability indicators, making it ideal for compliance and funding prep.

- Khatabook Biz Analyst

Beyond bookkeeping, it offers business insights such as customer payment cycles, sales trends, and receivables, especially useful for retailers and distributors in Tier 2 and 3 cities.

- Zoho Books

Cloud-based accounting software tailored for MSMEs. Enables automatic bank reconciliation, GST filing, and customizable reports like cash flow statements and ratio analysis.

- QuickBooks India (for legacy users)

Although discontinued for new signups in India, many SMEs still use QuickBooks for its clean interface and efficient reporting. Users are now migrating to Zoho or international versions.

- ScoreMe

A financial and credit risk assessment platform that generates automated reports aligned with lender expectations. Useful for MSMEs preparing for loans or equity funding.

Actionable Takeaways for MSME Founders and CFOs

- Schedule quarterly financial check-ups—use tools to stay consistent, not just reactive.

- Integrate accounting software with bank feeds to automate cash flow tracking.

- Benchmark against peers in your sector—many tools provide industry ratios for comparison.

- Train your finance team or accountant on digital tools—upskilling is essential for accuracy and efficiency.

- Use assessment insights to revise pricing, credit terms, or procurement policies before problems escalate.

MSME Strategy Consultants

At msmestrategy.com, our experienced consultants help MSMEs identify the right financial tools, interpret diagnostics, and plan sustainable growth strategies. We’re here to support your journey with data-driven insights and real-world expertise.

#MSMEStrategy #FinancialHealth #DigitalMSME #SMEGrowthIndia #MSMEFinance #BusinessDiagnostics #CashFlowManagement #SmartAccounting